What Is The Tax Bracket For 2024 In Canada. Now for the good news on tax changes in canada for 2024, the federal tax brackets have been adjusted so that everyone pays slightly less federal taxes. This reference card is designed to help you and your clients with tax planning for the 2024 calendar year.

2024 federal tax bracket rates and income thresholds. Your taxable income is your income after various deductions, credits, and exemptions have been applied.

Below Are The Important Dates For The Canada Tax Return In 2024:

Employment insurance & cpp contributions.

2023 And 2024 Tax Brackets, As Well As 2023 And Most Of 2024 Tax Credits Have Been Verified To Canada Revenue Agency And Provincial Factors.

What are canada’s federal 2024 tax brackets and rates?

What Is The Tax Bracket For 2024 In Canada Images References :

Source: britaqpietra.pages.dev

Source: britaqpietra.pages.dev

2024 Tax Brackets Canada Calculator Aimil Ethelda, Information for individuals and businesses on rates such as federal and provincial/territorial tax rates, prescribed interest rates, ei rates, corporation tax rates, excise tax rates, and more. The calculator reflects known rates as of june 1, 2024.

Source: charylqdoretta.pages.dev

Source: charylqdoretta.pages.dev

Tax Brackets 2024 Canada Doro, Learn about changes, rates, and deadlines from the canada revenue agency (cra). Conquer the canadian tax maze in 2024!

Source: tabbyqlaurice.pages.dev

Source: tabbyqlaurice.pages.dev

When Can You Submit Taxes 2024 Canada Adore Mariska, 2024 federal tax bracket rates and income thresholds. Conquer the canadian tax maze in 2024!

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know, This figure presents the taxable income amount ($000,000) for the selected tax bracket or all tax brackets and the selected provinces and territories for the 2022 tax year. The esdc told daily hive that it had increased the child tax payment by 4.7% this july.

Source: marcellinawberyle.pages.dev

Source: marcellinawberyle.pages.dev

Federal Tax Canada 2024 Brinn Orelie, That means the maximum benefit for a child under six has increased by $350, from $7,437 to $7,787. We also pay taxes to the provincial or territorial government where we live, and each has its.

Source: auroreqconstance.pages.dev

Source: auroreqconstance.pages.dev

Tax Brackets 2024 Canada Kacie Chandra, For 2024 are the same as the rates for 2023—10%, 12%, 22%, 24%, 32%, 35%. Calculate your combined federal and provincial tax bill in each province and territory.

Source: veroniquewlilia.pages.dev

Source: veroniquewlilia.pages.dev

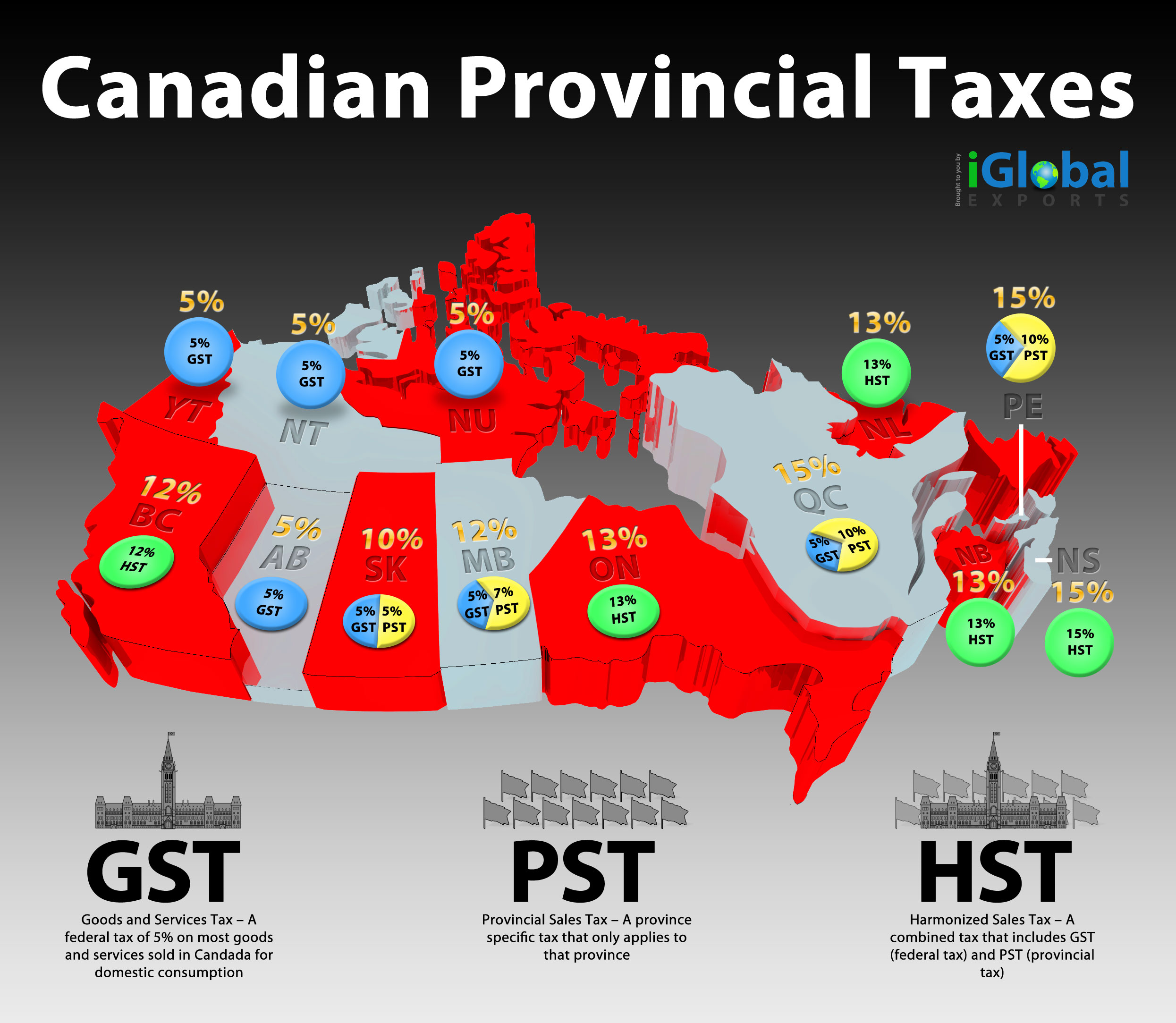

Tax Brackets 2024 Canada Nova Scotia Ardyce Lindsay, We also pay taxes to the provincial or territorial government where we live, and each has its. Your tax bracket is based on “taxable income,” which is your gross income from all sources, minus any tax deductions you may qualify for.

Source: callidawkacie.pages.dev

Source: callidawkacie.pages.dev

Tax Brackets 2024 For Single Person Drusy Sharon, Choose your province or territory below to see the combined federal & provincial/territorial marginal tax rates for each tax bracket. Canada 2024 and 2023 tax rates & tax brackets.

Source: www.axios.com

Source: www.axios.com

2024 tax brackets IRS inflation adjustments to boost paychecks, lower, For kids aged six to 17, it’s increased by. If you earned an extra $1,000, you will have to pay an additional 29.65% of that amount in tax, or $296.50.

Source: www.pinterest.ca

Source: www.pinterest.ca

The table shows the tax brackets that affect seniors, once you include, However, you can use them in advance to plan out any personal finance moves to lower the tax bill you’ll pay in 2025. Canada child benefit, child disability benefit.

The Indexation Increase For 2024 Is 4.7 Per Cent, According To The Canada Revenue Agency (Cra).

This is, in part, due to the progressivity of canada’s tax system, where the share of taxes paid typically increases as income rises.

Your Taxable Income Is Your Income After Various Deductions, Credits, And Exemptions Have Been Applied.

Learn how the new tax bracket thresholds and indexed rates may impact your tax bill.

Posted in 2024